Contact us:

Tacoma: (253) 244-5520

Lynnwood : (425) 678-1251

Send us a Message

Cameron@TheMedicareExchange.org

Opening Hours

Mon - Friday: 8AM - 5PM

Life Insurance

Different Types

Term Life Insurance

Term life insurance charges a fixed monthly premium over the life of the policy, for a fixed death benefit should the policyholder die during the term. It is not meant to cover someone until they die but rather provides protection against sudden income loss or ongoing debt, like a mortgage, in increments of 5 to 10 years.

Usually, providers offer terms of 5, 10, 15, 20, or sometimes as much as 30 years. The “set it and forget it” system of fixed premiums and fixed death benefits make it ideal to budget with, providing an efficient safety net for a relatively small amount each month.

Term life insurance is not suited for those who seek more flexible financial bonuses with their life insurance policy. Generally, term life plans award only death benefits and do not accrue money or otherwise allow policyholders to take advantage of the policy’s cash value.

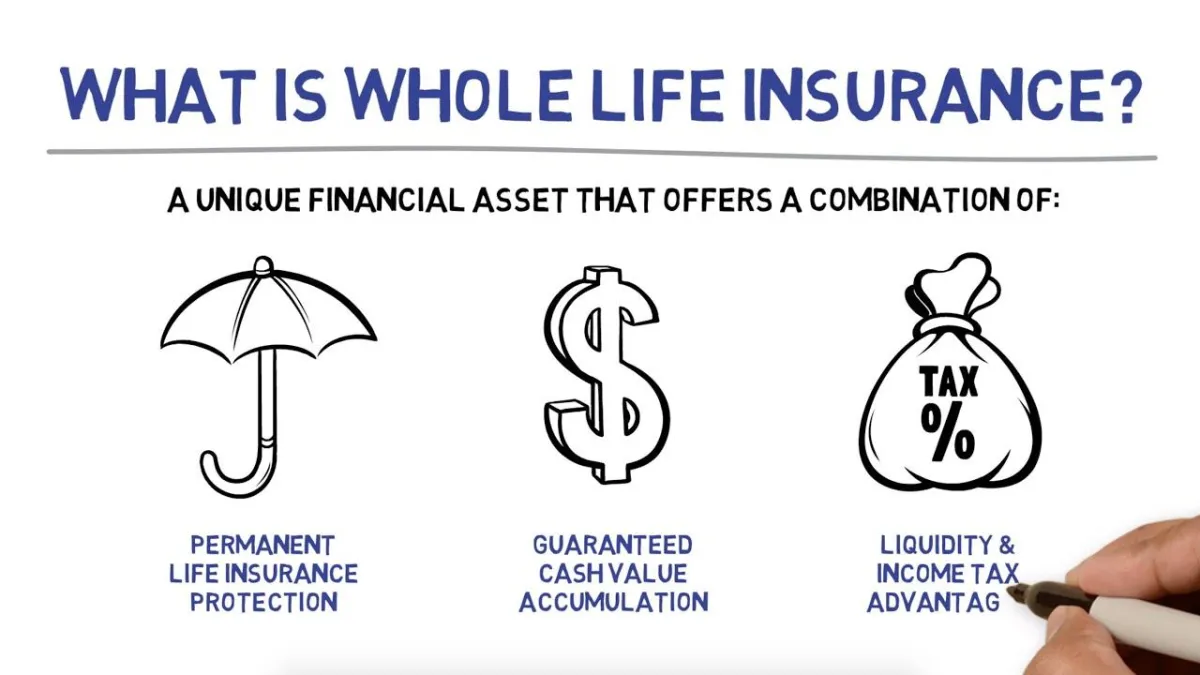

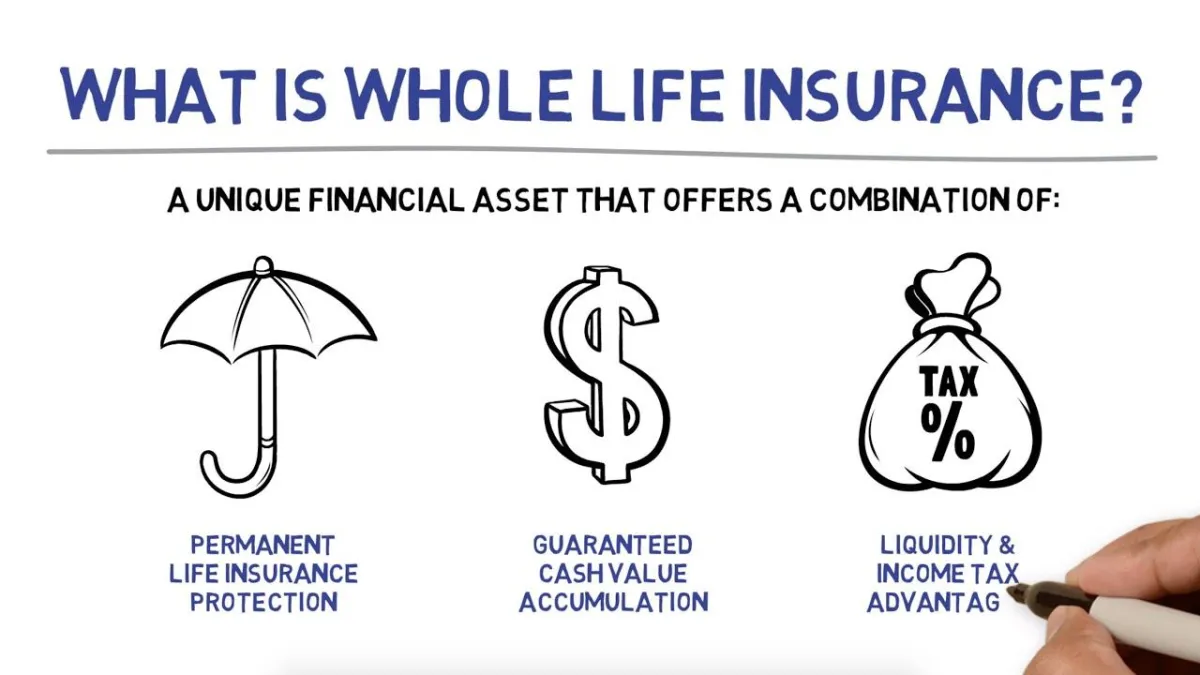

Whole Life Insurance

Whole life insurance is different from term life in that it covers the policyholder for their entire life, pays out to a specified beneficiary when the policyholder dies, and accrues extra cash value over time.

Premiums for whole life plans are fixed, are based on the age of the applicant at the time the policy is opened, and are usually higher than term life premiums due to policyholder coverage for a longer period of time.

The advantages that come along with whole life insurance are well-suited to the needs someone may experience over a long life. A primary feature of whole life policies is the ability to benefit financially.

Many established providers pay dividends that are a nice yearly bonus based on performance, and policyholders can employ the cash value of their policy in several ways that help them deal with financial or medical needs that may arise.

Term Life Insurance

Term life insurance charges a fixed monthly premium over the life of the policy, for a fixed death benefit should the policyholder die during the term. It is not meant to cover someone until they die but rather provides protection against sudden income loss or ongoing debt, like a mortgage, in increments of 5 to 10 years.

Usually, providers offer terms of 5, 10, 15, 20, or sometimes as much as 30 years. The “set it and forget it” system of fixed premiums and fixed death benefits make it ideal to budget with, providing an efficient safety net for a relatively small amount each month.

Term life insurance is not suited for those who seek more flexible financial bonuses with their life insurance policy. Generally, term life plans award only death benefits and do not accrue money or otherwise allow policyholders to take advantage of the policy’s cash value.

Whole Life Insurance

Whole life insurance is different from term life in that it covers the policyholder for their entire life, pays out to a specified beneficiary when the policyholder dies, and accrues extra cash value over time.

Premiums for whole life plans are fixed, are based on the age of the applicant at the time the policy is opened, and are usually higher than term life premiums due to policyholder coverage for a longer period of time.

The advantages that come along with whole life insurance are well-suited to the needs someone may experience over a long life. A primary feature of whole life policies is the ability to benefit financially.

Many established providers pay dividends that are a nice yearly bonus based on performance, and policyholders can employ the cash value of their policy in several ways that help them deal with financial or medical needs that may arise.

Universal Life Insurance

While whole life insurance covers the policyholder for their entire life, universal life does the same but with different financial incentives. Whole life policies offer a level rate and steady cash value gain while universal life gives the ability to flexibly adjust the premium and death benefit balance, invest premiums along with the policy’s cash value, and save money in a variety of unique ways.

Premiums can be adjusted upwards to increase the death benefit at will, and can also exceed the minimum amount to add to the cash value of the policy in an intentional manner. If the premiums are covered every month, either through payment or by returns on smart investments, the policy stays in effect and keeps growing.

The biggest benefit comes by way of allowing policyholders to use this cash value. The uses may include borrowing funds with the policy as collateral, withdrawing cash, paying for medical treatment, specifically stipulating how death benefits are paid to beneficiaries, and the ability to pay ongoing premiums with returns.

This might be a particularly attractive strategy for younger people seeking out universal policies since they have usually not had a very long investing track record. Many universal life policies allow policyholders to invest their premiums and excess cash value as they see fit. Young couples without other investments are well-served by the ability to flexibly add to their premiums considering the prospect of earning higher returns.

Universal Life Insurance

While whole life insurance covers the policyholder for their entire life, universal life does the same but with different financial incentives. Whole life policies offer a level rate and steady cash value gain while universal life gives the ability to flexibly adjust the premium and death benefit balance, invest premiums along with the policy’s cash value, and save money in a variety of unique ways.

Premiums can be adjusted upwards to increase the death benefit at will, and can also exceed the minimum amount to add to the cash value of the policy in an intentional manner. If the premiums are covered every month, either through payment or by returns on smart investments, the policy stays in effect and keeps growing.

The biggest benefit comes by way of allowing policyholders to use this cash value. The uses may include borrowing funds with the policy as collateral, withdrawing cash, paying for medical treatment, specifically stipulating how death benefits are paid to beneficiaries, and the ability to pay ongoing premiums with returns.

This might be a particularly attractive strategy for younger people seeking out universal policies since they have usually not had a very long investing track record. Many universal life policies allow policyholders to invest their premiums and excess cash value as they see fit. Young couples without other investments are well-served by the ability to flexibly add to their premiums considering the prospect of earning higher returns.

AND MORE....

Let us help you live a healthy, happy,

stress-free retirement.

About Us

Our company has been serving clients for 8+ years. We not only love what we do but we love who we serve. Whether you are looking for Medicare plans, Life insurance or Financial services, etc. The Medicare Exchange is the go-to company for all of your retirement needs.

Opening Hours

Monday - 08:00-5:00

Tuesday - 08:00-5:00

Wednesday - 08:00-5:00

Thursday - 08:00-5:00

Friday - 08:00-5:00

Saturday & Sunday - BY APPOINTMET ONLY

We value your privacy very highly. Please read this Privacy Policy carefully before using the Website operated by The Medicare Exchange LLC, a(n) Limited Liability Company formed in Washington, United States ("us," "we," "our") as this Privacy Policy contains important information regarding your privacy and how we may use the information we collect about you.

Your access to and use of the Website is conditional upon your acceptance of and compliance with this Privacy Policy. This Privacy Policy applies to everyone, including, but not limited to: visitors, users, and others, who wish to access or use the Website.

By accessing or using the Website, you agree to be bound by this Privacy Policy. If you disagree with any part of the Privacy Policy, then you do not have our permission to access or use the Website.

To access our full Privacy Policy click HERE

Let us help you live a healthy, happy,

stress-free retirement.

Client Testimonials

Duke was absolutely Superb! He helped find a way for me to pas on a legacy gift to my daughters, when I didn't think I could. Very satisfied with his service !

Anne S.

Nicole is a very nice caring person. She is interested in you as a person. She truly cares, and loves to help you reach your goals. She spends time with you till all your questions are answered. She doesn’t just sign you up for a plan. She comes back to see if you like the plan your on.

Becky S.

Tony bent over backwards for me and went above and beyond.

Robert A.

Amber was SPECTACULAR! She listened and was patient and explained things to so I could understand. She is so sweet!

Lori W.

Nicole is a very knowledgeable lady. She was able to help my wife get a health plan that was perfect for our needs. She followed up exactly as she said she would. I don't know how my wife and I would have done it without her. I highly recommend her services. Thank you Nicole!

Dale B.

Nicole Pedersen is a very educated broker on health benefits. She has helped me very much and has always been so nice and pleasant to work with. I can always depend on her whenever I need her.

Claudette S.

Hats off to Medicare Exchange! Why, because Dale Eller is the ‘complete package’ wanted to leave message about Dale because he has gone ‘above and beyond’ to not only meet up with me but was patient enough to allow me to meet on my time. This is a rare commodity today. He is cordial, comfortable and easy to talk to with exhibiting a high level of professionalism. His knowledge, background and years of expertise allowed him to meet my needs and get to a solutions quickly. This stuff is complicated and I was going die. The wrong path until Dale and I met. He has steered me in the most optimal direction tailored to fit my needs Feel very fortunate that Dale reached out to me and know I will be in good hands now and later as I needed his support going into my future plans. Please give Dale the opportunity to talk with you, he will guide and tailor your next steps to meet your personal needs! Thanks again Dale, looking forward to our next step! Ask for Dale Eller he's your man!

Julie B.

Shane has been amazing to work with. His true dedication to finding the best options for us is to be commended. We always appreciate Shane's willingness to go above and beyond in assisting us. We not only consider Shane to be our agent, but we consider him to be a true friend. How Blessed we are to have Shane in our life

Dave & Lynne M.

Tony and Audra helped me pick a plan that will work with my doctors and not cost me a lot to see my specialist. They answer my calls and questions. They are good, caring people.

Barbara M.

Nicole was very helpful. She was able to find the best plan for me. Thank you Nicole.

Edgar D.

Susan is an AMAZING Medicare Advisor/Navigator ! She is truly interested in each of her clients getting the best plan for them and will review the various choices with you, while making the best recommendation and explaining why it is her recommendation in easy-to-understand language. She makes sure to ask pertinent questions regarding your health and life situation to assure this. It is clear this is important to her, to deliver what I’d call ‘Concierge Service’ … at least that’s what you feel like you’re getting! Each year in the Enrollment Period, she makes an in-person appointment with you to answer any questions, and tell you any changes in your plan or coverage she recommends. It is very, very clear that she knows each plan and each nuance and all the updates perfectly. She is extremely professional and her clear knowledge instills confidence that you’re getting the best plan for you. My own experience is that I’ve had slight changes in my plan each year, and each year it’s worked out I had the best coverage I could get with the changes that were made, both in services and cost. I could not be more happy and satisfied with Susan’s service. She’s prompt, smart, after your best interests, enthusiastic, available/responsive to calls … I couldn’t recommend anyone that would do a better job. Like I said at beginning- SUSAN IS TRULY AMAZING… And I wonder if there’s a way of making this testimonial stronger?!

Cheryl M. P.

Audra and Albert have been outstanding representatives. They have answered all my questions. I appreciate the follow up they have given me since I signed up with them. I will be referring them to one of my friends in the near future because they have been so helpful and professional with me

Paula A.

I just today saw the article on your website about the wonderful party Tacoma had for my 86th birthday on July 17, 2023. I didn't realize when I set an appointment with Amber for that day that It was going to be a party! Thank all of you for that, and Amber for baking the biggest, roundest, most chocolatie, most decadent, most perfect birthday cake I've ever seen or eaten! And she very sweetly added just enough candles but not enough to cause a fire ..... Thank all of you, also, for being there for me and other seniors like myself - Amber and Alejandra have helped me throughout my entire health insurance problem, answering every question instantly and with total knowledge. I am recommending ya'll to everyone I know, including the Coordinator at my apartment complex. Thanks again!

Darlyne J.

About Us

Our company has been serving clients for 9+ years. We not only love what we do but we love who we serve. Whether you are looking for Medicare plans, Life insurance or Financial services, etc. The Medicare Exchange is the go-to company for all of your retirement needs.

Opening Hours

Monday - 08:00-5:00

Tuesday - 08:00-5:00

Wednesday - 08:00-5:00

Thursday - 08:00-5:00

Friday - 08:00-5:00

Saturday & Sunday - BY APPOINTMET ONLY

The Medicare Exchange is not affiliated or endorsed by the federal Medicare program. Calling our phone number will connect you to a licensed broker who is trained and certified to help you review the plan options available in your area. We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all your options

© Copyright 2023 The Medicare Exchange | All Rights Reserved | Privacy Policy