Contact us:

Tacoma: (253) 244-5520

Lynnwood : (425) 678-1251

Send us a Message

Cameron@TheMedicareExchange.org

Opening Hours

Mon - Friday: 8AM - 5PM

Medicare

Who is eligible for Medicare?

Generally, U.S. citizens and permanent residents aged 65 and older are eligible for Medicare. Additionally, some younger people with disabilities, end-stage renal disease (ESRD), or amyotrophic lateral sclerosis (ALS) can also qualify.

People 65 and older

People with disabilities

People with ESRD or ASL

Medicare has different parts that help cover specific services:

Medicare has different parts that help cover specific services:

Medicare Part A

(Hospital Insurance)

Covers inpatient hospital stays, skilled nursing facility care, hospice care, and some home health care.

Part A helps cover inpatient care in hospitals, including critical access hospitals, and skilled nursing facilities (not custodial or long-term care). It also helps cover hospice care and some home health care. Beneficiaries must meet certain conditions to get these benefits. Most people don't pay a premium for Part A because they or a spouse already paid for it through their payroll taxes while working.

Medicare Part B

(Medical Insurance)

Covers certain doctors' services, outpatient care, medical supplies, and preventive services.

Part B helps cover doctors' services and outpatient care. It also covers some other medical services that Part A doesn't cover, such as some of the services of physical and occupational therapists, and some home health care. Part B helps pay for these covered services and supplies when they are medically necessary. Most people pay a monthly premium for Part B.

Medicare Part D

(Prescription Drug Coverage)

Covers prescription drug costs. It's offered by private insurance companies approved by Medicare.

Medicare prescription drug coverage is available to everyone with Medicare. To get Medicare prescription drug coverage, people must join a plan approved by Medicare that offers Medicare drug coverage. Most people pay a monthly premium for Part D.

Options After Obtaining Original Medicare

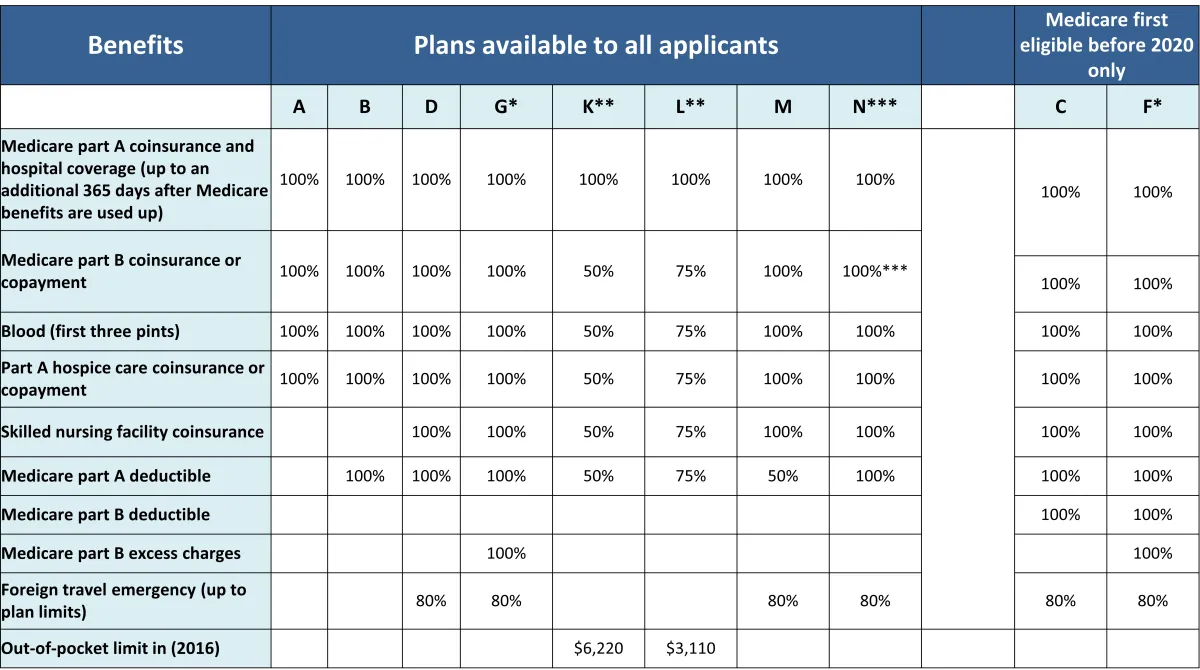

Medicare Supplements

(Medigap)

Medigap, also known as Medicare Supplement Insurance, is private insurance that can help pay some of the healthcare costs that Original Medicare doesn't cover, like copayments, coinsurance, and deductibles.

Medicare Advantage

(Part C)

An alternative to original Medicare (Part A and Part B) offered by private insurance companies approved by Medicare. It often includes both Part A and Part B coverage and sometimes prescription drug coverage (Part D).

Part C is another way to get your Medicare Part A and Part B coverage, and sometimes Part D. This type of plan consists of lower monthly premiums, but there are co-pays, co-insurance, and maximum out of pockets, as well as some perks like Dental, Vision, Hearing and Gym memberships.

Frequently Asked Questions

Can I have both Medicare and private health insurance?

Yes, you can have both. When you have other insurance (like employer insurance) along with Medicare, there are rules that decide which insurance pays first.

When can I sign up for Medicare?

Your initial enrollment period starts three months before you turn 65 and ends three months after the month you turn 65. There are also special enrollment periods based on certain situations and an annual open enrollment period.

Do I need to sign up for Medicare if I'm still working at 65?

If you have health coverage through your employer or your spouse's employer, you may not need to sign up for Part B right away. However, it's crucial to speak with the Social Security Administration and your benefits administrator to make the right decisions about enrollment.

How do I apply for Medicare?

You can apply for Medicare through the Social Security Administration. You can apply online, visit your local Social Security office, or call Social Security at 1-800-772-1213.

What is the difference between Medicare and Medicaid?

Medicare is a federal program primarily for seniors and certain disabled individuals, regardless of income. Medicaid is a state and federally funded program designed to provide health coverage for low-income individuals.

If I'm already receiving Social Security benefits, do I need to enroll in Medicare separately?

No. If you're already receiving Social Security benefits when you turn 65, you'll be automatically enrolled in Medicare Part A and Part B.

What if I miss my Medicare initial enrollment period?

If you miss your initial enrollment period, you can sign up during the General Enrollment Period, which is January 1 through March 31 each year, but you may face a late enrollment penalty.

Are prescription drugs covered under Original Medicare?

Original Medicare does not generally cover prescription drugs. You'd need to enroll in a separate Part D plan or a Medicare Advantage Plan that offers drug coverage.

Can I switch from Original Medicare to a Medicare Advantage plan?

Yes, you can make this switch during the annual Open Enrollment Period, which runs from October 15 to December 7.

What is a Medicare Advantage Plan's network?

Many Medicare Advantage Plans have a network of doctors, specialists, and hospitals that you must use to get the lowest rates. There are different types of networks, such as HMOs or PPOs, each with its own rules.

Can I have both a Medicare Advantage Plan and a Medigap policy?

No. It's illegal for anyone to sell you a Medigap policy if you have a Medicare Advantage Plan, unless you're switching back to Original Medicare.

Are preventive services covered by Medicare?

Yes, many preventive services, like screenings and vaccines, are covered by Medicare Part B. Often, these are covered at no cost to you.

What happens if I move out of state?

If you have Original Medicare, moving won't affect your coverage. If you have a Medicare Advantage Plan or a Part D prescription drug plan, you might need to choose a new plan available in your new location.

Can I travel with my Medicare coverage?

Original Medicare generally only covers services within the U.S. and its territories. Many Medicare Advantage Plans also restrict services to their network areas, but may offer coverage for emergencies during travel.

What is the "donut hole" in relation to Medicare Part D?

The "donut hole" refers to a gap in prescription drug coverage. Once you and your plan have spent a certain amount on covered drugs, you may be in the "donut hole" and pay more out-of-pocket for prescriptions until reaching a yearly limit.

What is the Medicare Savings Program?

The Medicare Savings Program can help low-income individuals pay for their Medicare premiums and, in some cases, other cost-sharing. Eligibility and benefits vary by state.

Does Medicare cover long-term care?

Medicare does not generally cover long-term care if that's the only care you need. While Medicare Part A does cover skilled nursing facility care, it's under specific conditions and for limited time periods, not for long-term stays.

What is the difference between a Medicare Advantage HMO plan and a PPO plan?

Both HMO (Health Maintenance Organization) and PPO (Preferred Provider Organization) are types of Medicare Advantage Plans, but they have differences:

HMO: Typically, you need to choose a primary care doctor and get a referral to see a specialist. You are usually required to use doctors and providers in the plan's network, except for emergencies.

PPO: You don't need to choose a primary care doctor and don't require referrals to see specialists. You can use doctors in or out of your plan's network, but using the network will cost you less.

What if my doctor doesn't accept Medicare?

If your doctor doesn't accept Medicare, you may have to pay the full cost of the services provided. However, in some cases, doctors who don’t participate in Medicare may still choose to accept Medicare's approved amount for certain services, but they can charge you up to 15% over that amount (known as "excess charges").

How does Medicare work with my Health Savings Account (HSA)?

If you have an HSA and enroll in Medicare, you can't contribute to your HSA anymore. However, you can still use the money in your HSA to pay for medical expenses, including Medicare premiums and out-of-pocket expenses.

AND MORE....

AND MORE....

Let us help you live a healthy, happy,

stress-free retirement.

About Us

Our company has been serving clients for 8+ years. We not only love what we do but we love who we serve. Whether you are looking for Medicare plans, Life insurance or Financial services, etc. The Medicare Exchange is the go-to company for all of your retirement needs.

Opening Hours

Monday - 08:00-5:00

Tuesday - 08:00-5:00

Wednesday - 08:00-5:00

Thursday - 08:00-5:00

Friday - 08:00-5:00

Saturday & Sunday - BY APPOINTMET ONLY

We value your privacy very highly. Please read this Privacy Policy carefully before using the Website operated by The Medicare Exchange LLC, a(n) Limited Liability Company formed in Washington, United States ("us," "we," "our") as this Privacy Policy contains important information regarding your privacy and how we may use the information we collect about you.

Your access to and use of the Website is conditional upon your acceptance of and compliance with this Privacy Policy. This Privacy Policy applies to everyone, including, but not limited to: visitors, users, and others, who wish to access or use the Website.

By accessing or using the Website, you agree to be bound by this Privacy Policy. If you disagree with any part of the Privacy Policy, then you do not have our permission to access or use the Website.

To access our full Privacy Policy click HERE

Let us help you live a healthy, happy,

stress-free retirement.

Client Testimonials

Duke was absolutely Superb! He helped find a way for me to pas on a legacy gift to my daughters, when I didn't think I could. Very satisfied with his service !

Anne S.

Nicole is a very nice caring person. She is interested in you as a person. She truly cares, and loves to help you reach your goals. She spends time with you till all your questions are answered. She doesn’t just sign you up for a plan. She comes back to see if you like the plan your on.

Becky S.

Tony bent over backwards for me and went above and beyond.

Robert A.

Amber was SPECTACULAR! She listened and was patient and explained things to so I could understand. She is so sweet!

Lori W.

Nicole is a very knowledgeable lady. She was able to help my wife get a health plan that was perfect for our needs. She followed up exactly as she said she would. I don't know how my wife and I would have done it without her. I highly recommend her services. Thank you Nicole!

Dale B.

Nicole Pedersen is a very educated broker on health benefits. She has helped me very much and has always been so nice and pleasant to work with. I can always depend on her whenever I need her.

Claudette S.

Hats off to Medicare Exchange! Why, because Dale Eller is the ‘complete package’ wanted to leave message about Dale because he has gone ‘above and beyond’ to not only meet up with me but was patient enough to allow me to meet on my time. This is a rare commodity today. He is cordial, comfortable and easy to talk to with exhibiting a high level of professionalism. His knowledge, background and years of expertise allowed him to meet my needs and get to a solutions quickly. This stuff is complicated and I was going die. The wrong path until Dale and I met. He has steered me in the most optimal direction tailored to fit my needs Feel very fortunate that Dale reached out to me and know I will be in good hands now and later as I needed his support going into my future plans. Please give Dale the opportunity to talk with you, he will guide and tailor your next steps to meet your personal needs! Thanks again Dale, looking forward to our next step! Ask for Dale Eller he's your man!

Julie B.

Shane has been amazing to work with. His true dedication to finding the best options for us is to be commended. We always appreciate Shane's willingness to go above and beyond in assisting us. We not only consider Shane to be our agent, but we consider him to be a true friend. How Blessed we are to have Shane in our life

Dave & Lynne M.

Tony and Audra helped me pick a plan that will work with my doctors and not cost me a lot to see my specialist. They answer my calls and questions. They are good, caring people.

Barbara M.

Nicole was very helpful. She was able to find the best plan for me. Thank you Nicole.

Edgar D.

Susan is an AMAZING Medicare Advisor/Navigator ! She is truly interested in each of her clients getting the best plan for them and will review the various choices with you, while making the best recommendation and explaining why it is her recommendation in easy-to-understand language. She makes sure to ask pertinent questions regarding your health and life situation to assure this. It is clear this is important to her, to deliver what I’d call ‘Concierge Service’ … at least that’s what you feel like you’re getting! Each year in the Enrollment Period, she makes an in-person appointment with you to answer any questions, and tell you any changes in your plan or coverage she recommends. It is very, very clear that she knows each plan and each nuance and all the updates perfectly. She is extremely professional and her clear knowledge instills confidence that you’re getting the best plan for you. My own experience is that I’ve had slight changes in my plan each year, and each year it’s worked out I had the best coverage I could get with the changes that were made, both in services and cost. I could not be more happy and satisfied with Susan’s service. She’s prompt, smart, after your best interests, enthusiastic, available/responsive to calls … I couldn’t recommend anyone that would do a better job. Like I said at beginning- SUSAN IS TRULY AMAZING… And I wonder if there’s a way of making this testimonial stronger?!

Cheryl M. P.

Audra and Albert have been outstanding representatives. They have answered all my questions. I appreciate the follow up they have given me since I signed up with them. I will be referring them to one of my friends in the near future because they have been so helpful and professional with me

Paula A.

I just today saw the article on your website about the wonderful party Tacoma had for my 86th birthday on July 17, 2023. I didn't realize when I set an appointment with Amber for that day that It was going to be a party! Thank all of you for that, and Amber for baking the biggest, roundest, most chocolatie, most decadent, most perfect birthday cake I've ever seen or eaten! And she very sweetly added just enough candles but not enough to cause a fire ..... Thank all of you, also, for being there for me and other seniors like myself - Amber and Alejandra have helped me throughout my entire health insurance problem, answering every question instantly and with total knowledge. I am recommending ya'll to everyone I know, including the Coordinator at my apartment complex. Thanks again!

Darlyne J.

About Us

Our company has been serving clients for 9+ years. We not only love what we do but we love who we serve. Whether you are looking for Medicare plans, Life insurance or Financial services, etc. The Medicare Exchange is the go-to company for all of your retirement needs.

Opening Hours

Monday - 08:00-5:00

Tuesday - 08:00-5:00

Wednesday - 08:00-5:00

Thursday - 08:00-5:00

Friday - 08:00-5:00

Saturday & Sunday - BY APPOINTMET ONLY

The Medicare Exchange is not affiliated or endorsed by the federal Medicare program. Calling our phone number will connect you to a licensed broker who is trained and certified to help you review the plan options available in your area. We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all your options

© Copyright 2023 The Medicare Exchange | All Rights Reserved | Privacy Policy